Stop Translating. Start Researching.

You ran your US keyword list through Google Translate, created content in German, and waited for the international traffic to roll in. Six months later: nothing.

Here's what went wrong: Germans don't search for translated versions of English queries. They search for different things entirely. The product names are different. The buying behavior is different. The questions people ask are different. And Google Germany isn't Google US with a language filter.

I've seen companies spend six figures localizing content that nobody in the target market actually searches for. They translate "best project management software" and wonder why they're invisible in Germany, not realizing Germans search for "Projektmanagement Software Vergleich" (comparison), a completely different keyword structure with different intent.

The companies winning at international SEO don't translate keywords. They research keywords from scratch in each market. Different tools. Different approach. Different results.

In this guide, you'll learn how to research keywords for any country or language, not by translating, but by discovering what your target audience actually types into Google. We'll cover localized tools, why native speakers are non-negotiable, how to analyze foreign SERPs, and how to prioritize which markets deserve your resources.

Translation is a shortcut. Shortcuts don't work in international SEO.

Why Translation Fails (The Real Reason)

The instinct makes sense: you have a keyword list that works in the US, so translate it for other markets. Fast, cheap, logical.

And completely wrong.

What You're Actually Doing When You Translate

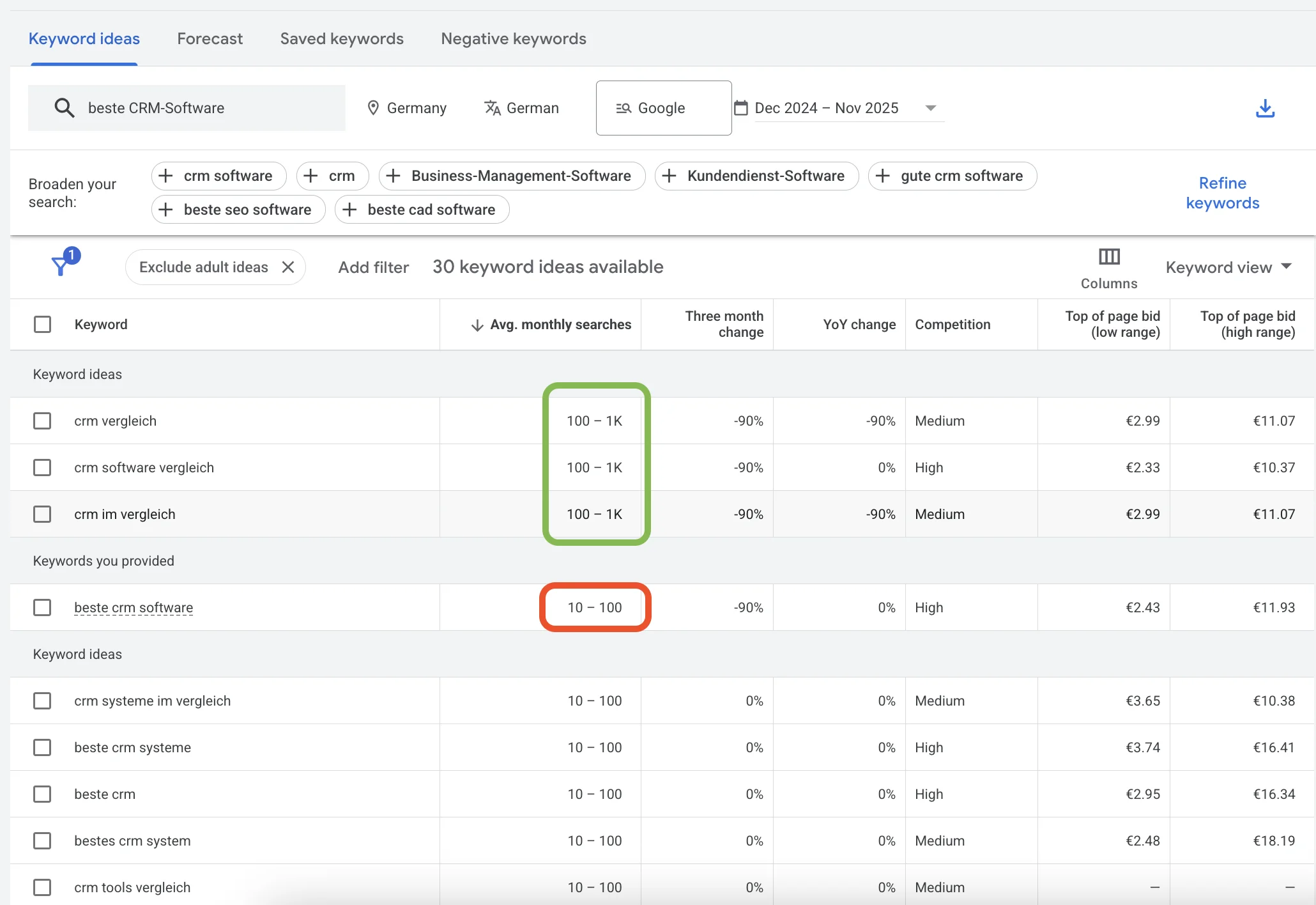

When you translate "best CRM software," you get "beste CRM-Software" in German. Grammatically correct. Semantically accurate. And probably not what Germans search for.

Germans might search "CRM Software Vergleich" (comparison), "CRM Software für kleine Unternehmen" (for small businesses), or "CRM Software Test" (test/review). These aren't translations of your English keywords. They're different queries with different intent, written by people with different buying behavior.

The gap between translated keywords and actual search queries:

| Your Translation | What People Actually Search |

|---|---|

| beste CRM-Software | CRM Software Vergleich |

| Projektmanagement-Tools | Projektmanagement Software kostenlos |

| E-Mail-Marketing-Software | Newsletter Tool Vergleich |

This isn't a German problem. It's an everywhere problem.

Cultural Context Changes Everything

In Japan, brand trust matters more than in the US. Japanese searchers often include brand names in queries, even for discovery searches. "Salesforce 代替" (Salesforce alternative) might outperform the generic "CRM ソフトウェア" (CRM software).

In Germany, searchers want detailed specifications and comparisons. "Test" and "Vergleich" appear in queries far more than their English equivalents.

In Spain, the informal "tú" form dominates searches, while your translator might use the formal "usted" because it's "proper." Both are Spanish. One matches how people actually search.

Local Competitors Dominate Local SERPs

Search "best accounting software" in Germany. The results aren't translated versions of US articles. They're German sites writing for German businesses dealing with German tax laws and German accounting standards.

Google knows that German searchers want German-specific answers. Your translated content competes against purpose-built local content. Guess who wins.

The fix isn't better translation. It's treating each market as its own keyword research project.

Step 1: Start with Concepts, Not Keywords

Before opening any tool, forget your English keywords. Start with concepts.

What Problem Does Your Product Solve?

Write down the core problems your product addresses. Not in English keyword terms. In human terms:

- What pain does your product eliminate?

- What outcome does it create?

- What category does it belong to?

- What do people compare it against?

These concepts exist in every language. The keywords that represent them don't translate directly, but the problems do.

Example concept map:

| Concept | Not a Keyword, Just the Idea |

|---|---|

| Core problem | Teams waste time on manual project updates |

| Desired outcome | Automated status tracking, less meetings |

| Product category | Project management software |

| Comparison context | Alternatives to [competitor], [Tool A] vs [Tool B] |

| Learning content | How to run better projects, how to track deadlines |

This framework travels across languages because problems are universal. Keywords are not.

Find Local Competitors First

For each target market, identify 3-5 local competitors. Not American companies with translated sites. Actual local players.

Why? Because they've already done the keyword research. They know what locals search for. You'll reverse-engineer their strategy later.

Where to find local competitors:

- Search your concept terms in the local Google (google.de, google.fr, etc.)

- Check G2 and Capterra with country filters

- Ask your sales team who they lose deals to in that market

- Look at local industry publications and their advertisers

Document What You Know About the Market

Before researching, write down everything you know about how the target market differs:

- Do they prefer certain solutions or approaches?

- Are there local regulations affecting search behavior?

- What's the typical buying process?

- Are there dominant local platforms or marketplaces?

This context prevents you from misinterpreting data later. A keyword with 500 monthly searches means different things in markets with different online behaviors.

Step 2: Use Localized Keyword Tools

Your keyword tools are lying to you about international markets. By default, most show US or global data. For international SEO keyword research, you need location-specific data.

Google Keyword Planner (The Free Option That Actually Works)

Google Keyword Planner supports virtually every country. Most people don't know you can change the location.

How to get country-specific data:

- Sign into Google Ads (free account, no spending required)

- Go to Tools → Keyword Planner → Discover new keywords

- Click "Language" and select your target language

- Click "Location" and select your target country

- Enter concepts in the target language (rough translations are fine here)

The results show actual search volume for that specific country and language combination. Not estimates. Not global averages. Real local data.

Pro tip: Enter concepts in the local language, even if your translation is rough. Keyword Planner suggests related terms that native speakers actually use. Those suggestions are gold.

BrightKeyword for Multi-Market Comparison

If you're researching keywords across multiple countries, BrightKeyword lets you set location codes for different markets and compare keyword opportunities side by side. You see which keywords have volume in which countries, helping you spot where the real opportunities hide.

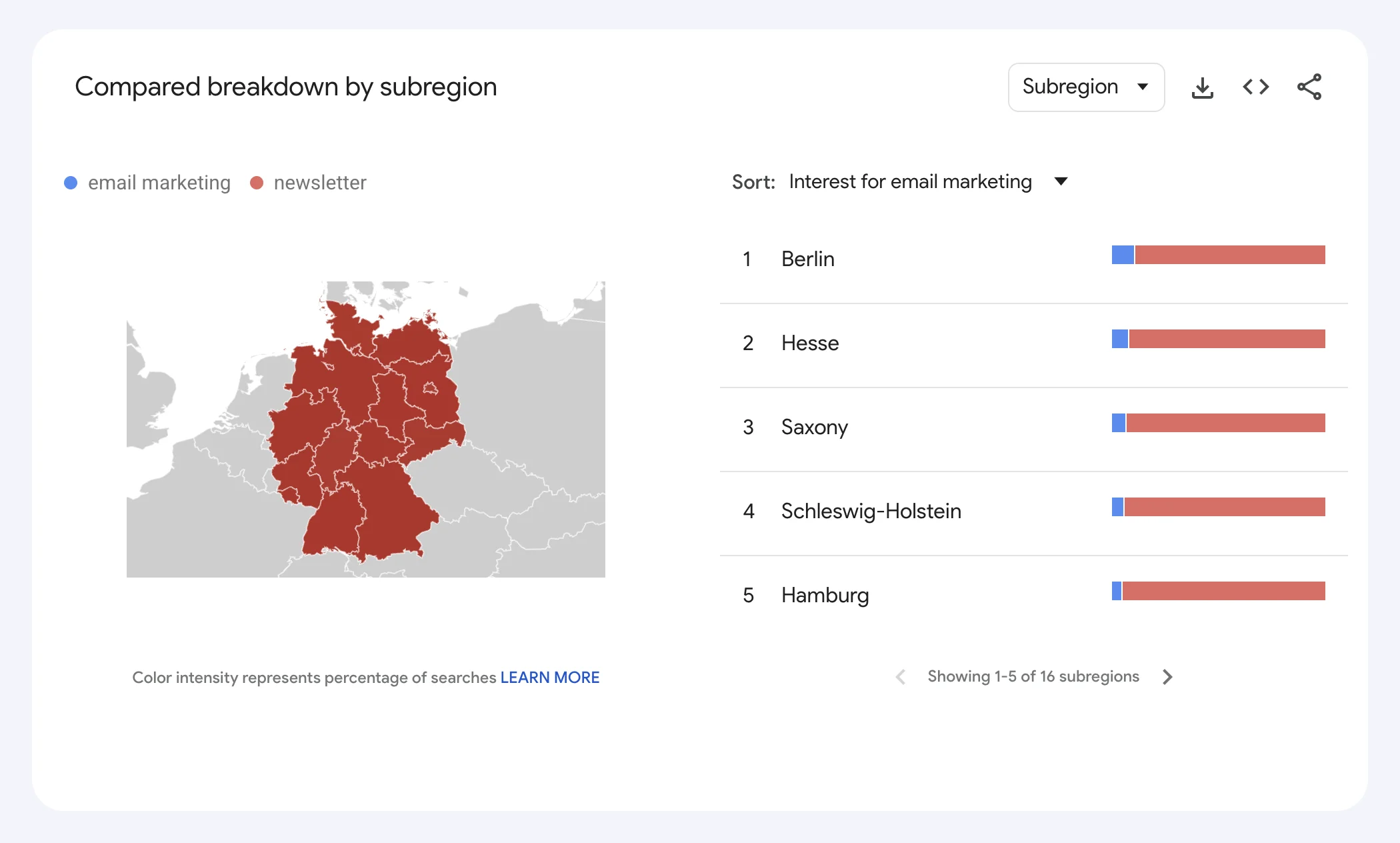

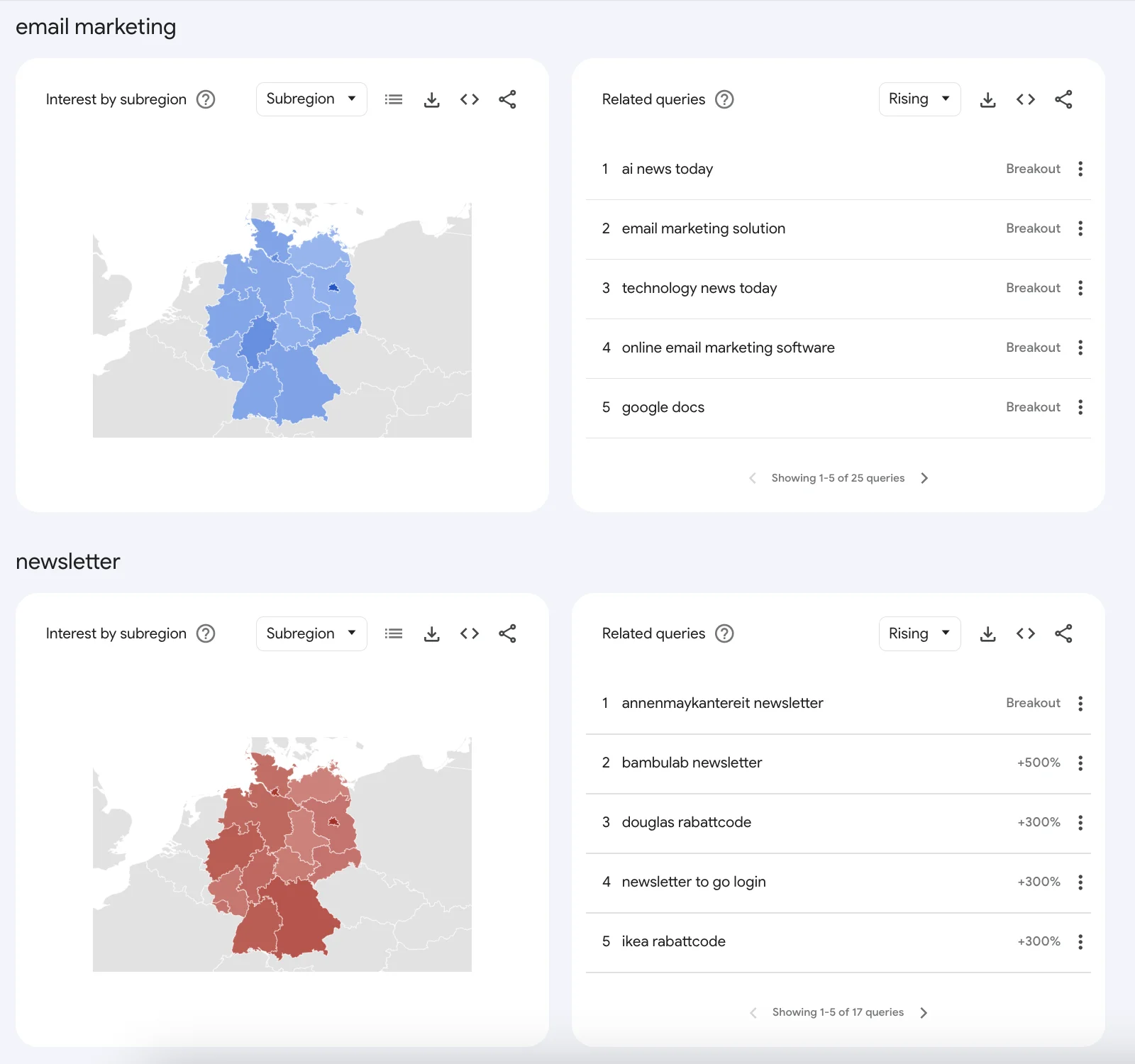

Google Trends: Underrated for International Research

Google Trends tells you things volume data can't:

- Which keyword variation dominates in your target country

- Regional popularity within a country (Berlin vs Munich vs Hamburg)

- Seasonal patterns that differ by market

- Rising queries that haven't hit volume thresholds yet

Set the country filter, compare your shortlisted keywords, and watch your assumptions crumble. Terms that dominate in one country often barely register in another.

Don't Forget Non-Google Markets

Google doesn't dominate everywhere. If you're targeting these markets, you need native tools:

| Market | Primary Search Engine | Keyword Tool |

|---|---|---|

| China | Baidu | Baidu Keyword Planner |

| Russia | Yandex (40%+ share) | Yandex Wordstat |

| South Korea | Naver (significant share) | Naver Keyword Tool |

| Japan | Google + Yahoo Japan | Both matter |

Ignoring local search engines in these markets is like ignoring Google in the US. You'll miss half your potential traffic.

Step 3: Get Native Speakers Involved (This Is Non-Negotiable)

Tools give you data. Native speakers give you context. You need both, but most companies skip the second part.

Why Tools Aren't Enough

A keyword tool can tell you "CRM Software" has 2,400 monthly searches in Germany. It can't tell you:

- Whether that phrase sounds natural or robotic

- If there's a colloquial alternative everyone uses instead

- Whether the search intent matches what you think it is

- If cultural context changes what people expect

Native speakers catch things tools miss. And those things determine whether your content ranks or gets ignored.

What Native Speakers Reveal

I've watched native speakers review "validated" keyword lists and immediately flag problems:

"Nobody says that." The keyword is grammatically correct but sounds like a textbook. Real people use a different phrase.

"That means something different here." Words that translate directly carry different connotations. "Software" in German sometimes implies enterprise-level, while "Tool" feels more accessible.

"You're using the wrong formality." In Spanish, searches use informal "tú" in Spain but vary across Latin America. In German, most searches skip formal language entirely.

"This is how we'd actually search." Instead of your translated keyword, they type something completely different and more natural.

How to Get Native Input

Option 1: Hire a native-speaking SEO specialist (best)

Someone who knows both SEO and the local language can do keyword research independently. Look for:

- Native speakers, not just fluent

- SEO experience in the target market

- Understanding of local search behavior

Option 2: Brief translators on SEO goals

Regular translators give you accurate translations that nobody searches for. Brief them on:

- The goal: finding searchable terms, not perfect translations

- The need for colloquial alternatives

- Providing multiple variations, not just one "correct" answer

Option 3: Leverage local teams

If you have sales or support teams in target markets, involve them. They know what customers call things, what questions they ask, and what competitors they mention. This is free intelligence sitting in your organization.

Questions to Ask Native Speakers

Give them your concept list and ask:

- "What would you type into Google to find information about [concept]?"

- "What are alternative ways people might phrase this?"

- "Are there slang or informal terms for this?"

- "Does this translated keyword sound natural or weird?"

- "What would a typical customer in [country] search for?"

Document everything. These answers become your real keyword list.

Step 4: Analyze Local SERPs Like a Local

Keyword volume tells you demand. SERP analysis tells you reality. For international SEO, you need to see what Google shows users in each target market.

How to View Local SERPs

Your default Google shows results for your location. To see what users in Germany, Japan, or Brazil see, you need to change your perspective.

Option 1: Change Google's location settings

- Go to the local domain (google.de, google.fr, google.co.jp)

- Scroll to the bottom, click Settings

- Select Search settings and change location

- Or add

&gl=DE(country code) to any Google URL

Option 2: Use a VPN

Connect to a server in your target country, then search normally. This gives you the most authentic local results.

Option 3: Use SERP checking tools

Tools like Ahrefs, Semrush, or dedicated SERP checkers let you specify location for SERP analysis without VPN gymnastics.

What to Look For

Search your target keywords and analyze the top 10 results. Ask:

What type of content ranks? Blog posts? Product pages? Comparison articles? Videos? Tools? If the top 10 are comparison articles and you're planning a product page, you're fighting the wrong battle.

How deep is the content? 500-word overviews or 5,000-word guides? This tells you the effort required to compete.

Who's ranking? Major brands or smaller local sites? If local blogs rank well, that's encouraging. If it's all enterprise players, prepare for a long fight.

What language are the results in? Obvious but important. If results are in a different language than your target, that keyword might have cross-border intent you didn't expect.

Competition Is Relative to Market

A German site with DR 50 might dominate German SERPs completely, even though your DR 80 US site crushes English results. Your authority doesn't transfer across markets.

Reality check each keyword:

| Factor | What to Check |

|---|---|

| Domain strength | What's the average DR of top 10? |

| Content quality | Is the current best result actually good? |

| Localization depth | Are results highly localized or generic? |

| Opportunity | Could you create something meaningfully better? |

Don't assume your English-market authority means anything in a new market. It usually doesn't.

Step 5: Build Your International Keyword List

Now combine everything: tool data, native speaker input, and SERP analysis into a structured keyword list for each market.

Keep Markets Separate

This is crucial: don't merge your keyword lists across markets.

A keyword that's high priority in Germany might be low priority in France. Markets have different volumes, different competition, different intent. One master list creates confusion. Separate lists create clarity.

Structure Your List

Create a spreadsheet with these columns:

| Column | Why It Matters |

|---|---|

| Keyword (local language) | The actual keyword you'll target |

| English equivalent | For your reference and team communication |

| Search volume | Monthly searches in that market |

| Competition | Low/Medium/High from your tool |

| CPC | Indicates commercial value |

| Search intent | Informational/Commercial/Transactional |

| SERP difficulty | Based on your manual analysis |

| Priority | Your ranking target priority |

| Target URL | Which page should rank |

| Notes | Native speaker feedback, SERP observations |

Group Keywords by Topic

Just like in any keyword research process, group related keywords that can be targeted with a single piece of content. In international SEO, this is even more important because you're likely creating fewer pieces of content in each language.

Example cluster (German market):

- Projektmanagement Software (project management software)

- Projektmanagement Tool (project management tool)

- Projektplanung Software (project planning software)

- beste Projektmanagement Software (best project management software)

One comprehensive piece of content can target all of these. Don't create four separate pages.

Separate by Content Type

Not all keywords need blog posts:

- Product/service pages: Transactional keywords with buying intent

- Blog posts: Informational and how-to keywords

- Comparison pages: "[X] vs [Y]" and "alternative to [X]" keywords

- FAQ/support content: Question keywords

- Resource pages: Tool and template keywords

Map each keyword cluster to the right content type before creating anything.

Step 6: Prioritize Markets by Opportunity, Not Size

You can't target every market at once. And the biggest markets aren't always the best opportunities.

Why Market Size Misleads

Germany has 80 million people. The Netherlands has 17 million. Obvious choice, right?

Not necessarily. If your niche has strong German competitors but weak Dutch competition, you might rank faster in the Netherlands and generate revenue while still building toward Germany.

Prioritize by opportunity, not population.

Factors That Actually Matter

Search volume in YOUR niche: A large country with low search volume for your topics is less valuable than a smaller country with high demand.

Competition intensity: Some markets are saturated with strong local players. Others have weak SERPs waiting to be disrupted.

Commercial value (CPC): High CPCs mean advertisers value that traffic. Usually because it converts.

Existing traction: If you already get traffic or have customers in a market, you have a foundation to build on.

Localization effort: Some markets require more work. Japanese localization is complex. UK English localization is minimal.

Business fit: Where does your company want to expand? Where do you have sales or support capacity?

Create a Market Scorecard

Score each potential market on these factors (1-10 scale):

| Market | Volume | Competition | CPC | Traction | Effort | Fit | Score |

|---|---|---|---|---|---|---|---|

| Germany | 8 | 4 | 9 | 5 | 6 | 9 | 41 |

| France | 7 | 7 | 7 | 3 | 6 | 7 | 37 |

| Netherlands | 5 | 8 | 6 | 2 | 7 | 6 | 34 |

| Japan | 9 | 3 | 8 | 1 | 3 | 6 | 30 |

Lower competition scores higher. Higher effort scores lower. Adjust weights based on what matters most to your business.

Start with One Market, Execute Fully

Don't spread yourself thin. Pick your top market and execute well before expanding.

Why this matters:

- You'll learn what works in international SEO

- You'll build processes you can replicate

- You'll show results before requesting more resources

- You'll avoid half-finished localization across many markets

One market done well beats five markets done poorly.

Case Study: Same Product, Three Countries, Completely Different Keywords

Let's see how international keyword research actually plays out. Same product category. Three markets. Completely different strategies.

The product: Email marketing software

United States

Primary keyword: "email marketing software" (40,500 monthly searches)

Top related keywords:

- best email marketing software (12,100)

- email marketing tools (8,100)

- email automation software (4,400)

What the SERP shows: Dominated by comparison articles from G2, Capterra, and major blogs. Product pages rank for branded terms only.

Strategy: Create comparison and category content. Compete on content depth, not product pages.

Germany

Primary keyword: "E-Mail Marketing Software" (2,400 monthly searches)

But here's what the tools reveal: "Newsletter Software" has 2,900 monthly searches. More than the translated term.

Top related keywords:

- Newsletter Software (2,900) ← Higher than "email marketing"!

- Newsletter Tool Vergleich (720)

- E-Mail Marketing Tool (1,300)

What this means: Germans search for "Newsletter Software" more than "E-Mail Marketing Software." Direct translation would have missed the primary keyword entirely.

Strategy: Target "Newsletter Software" as primary keyword. Create German comparison content with local examples and German-specific integrations.

Japan

Primary keyword: "メールマーケティングツール" (email marketing tool) (480 monthly searches)

But the research reveals: Different terminology entirely.

- メール配信システム (email delivery system) (1,600)

- メルマガ配信サービス (newsletter delivery service) (1,300)

What this means: Japanese searchers think about email differently. "メール配信" (email delivery) dominates over "メールマーケティング" (email marketing). The concept is framed as a delivery system, not a marketing tool.

Strategy: Target "メール配信システム" as primary keyword. Heavy localization of product messaging to match how Japanese businesses think about email.

What This Example Proves

- Volume varies dramatically (40K vs 2.4K vs 0.5K for the "same" term)

- Terminology differs (newsletter software vs email marketing)

- Competition differs (saturated vs moderate vs highly localized)

- Strategy must adapt to each market's reality

Translation would have given you the wrong primary keyword in both Germany and Japan. Research gave you the right ones.

Hreflang: Don't Skip This or Google Will Ignore Your Work

You researched keywords properly. You created localized content. Now you need to tell Google which version to show which users. Get hreflang wrong and all your work is wasted.

What Hreflang Does

Hreflang tags tell Google: "This page is for German speakers in Germany. That page is for English speakers in the US. Show the right one to the right user."

<link rel="alternate" hreflang="en-us" href="https://example.com/page" />

<link rel="alternate" hreflang="de-de" href="https://example.com/de/page" />

<link rel="alternate" hreflang="ja-jp" href="https://example.com/ja/page" />Without hreflang, Google guesses. And Google often guesses wrong, showing your English content to German searchers or your German content to Americans.

Common Hreflang Mistakes (That Break Everything)

Missing return links: If page A links to page B with hreflang, page B must link back to page A. Missing return links break the implementation entirely.

Wrong language codes: Use ISO 639-1 language codes and ISO 3166-1 country codes. "en-UK" is wrong. "en-GB" is correct. This mistake is embarrassingly common.

Forgetting x-default: Include a default version for users who don't match any specified language/country:

<link rel="alternate" hreflang="x-default" href="https://example.com/page" />Missing self-referencing tags: Each page should include a hreflang tag pointing to itself. Yes, it feels redundant. Do it anyway.

URL Structure Options

Pick one approach and stick with it:

| Structure | Example | Best For |

|---|---|---|

| Subdirectories | example.com/de/ | Most companies (easy, shared authority) |

| Subdomains | de.example.com | Separate teams or hosting needs |

| ccTLDs | example.de | Maximum local signal (expensive) |

For most companies, subdirectories offer the best balance of simplicity and effectiveness. They're easier to manage and share link equity across markets.

Track Rankings by Market

Use Google Search Console with separate properties for each market, or use rank tracking tools that support location-specific tracking.

Don't assume your global rankings reflect local performance. A page ranking #3 in the US might not rank at all in Germany. Track each market separately.

Frequently Asked Questions

What is multilingual keyword research?

Multilingual keyword research means finding search terms in multiple languages by researching what people in each language actually search for, not by translating keywords. It accounts for linguistic differences, cultural context, and local search behavior. Translation gives you grammatically correct keywords. Research gives you keywords people actually type.

Can I just translate my existing content for international SEO?

You can translate content, but you shouldn't translate keyword strategy. The content might work if properly localized (not just translated). But the keywords you target, the terms you optimize for, and the search intent you address need fresh research for each market. At minimum, everything needs review by a native speaker.

How many countries should I target at once?

Start with one or two. International SEO requires significant resources: keyword research, content creation, technical implementation, and ongoing optimization. Spreading across too many markets leads to poor execution everywhere. Master one market first, build repeatable processes, then expand.

What tools work for international keyword research?

Google Keyword Planner (with country/language settings), Google Trends (by region), BrightKeyword (with location codes), Ahrefs or Semrush (with country filters), and local tools like Yandex Wordstat for Russia or Baidu Keyword Planner for China. Use multiple tools and combine with native speaker input.

What is geo targeting in SEO?

Geo targeting means optimizing your site to rank for searches in specific geographic locations. This includes targeting country-specific keywords, using appropriate URL structures, implementing hreflang for language/country targeting, and creating content relevant to local audiences.

How do I know if a market is worth targeting?

Score markets on: search volume in your niche (not overall market size), competition intensity, commercial value (CPC data), your existing traction, localization effort required, and business fit. A smaller market with weaker competition and higher conversion potential often beats a larger market with entrenched competitors.

Build Your International Keyword Strategy

International SEO keyword research is harder than domestic research. There's no shortcut. Translation doesn't work. But done right, it opens markets that your competitors haven't properly addressed.

What separates winners from wasters:

- Winners research from scratch in each market

- Wasters translate and hope

- Winners involve native speakers from day one

- Wasters assume translation is good enough

- Winners analyze local SERPs to understand local competition

- Wasters assume their authority transfers across markets

- Winners prioritize by opportunity, not market size

- Wasters chase the biggest markets regardless of competition

The companies succeeding at international SEO treat each market as its own project. They invest in understanding local search behavior instead of assuming translation is enough.

Your competitors are probably translating. Which means they're probably ranking for the wrong keywords, creating content that doesn't match local intent, and wondering why international SEO "doesn't work."

That's your opportunity.

Ready to research keywords for your next market? Try BrightKeyword with your target country's location code and see what opportunities you've been missing.