The SaaS Keyword Problem: High Intent, Low Volume

Here's the frustrating reality of SEO for SaaS: the keywords that would bring you perfect customers often show "0-10 monthly searches" in your keyword tool.

Traditional keyword research advice tells you to chase volume. Find terms with thousands of monthly searches, optimize your content, and watch the traffic roll in. But for B2B SaaS companies, this approach leads to either:

- Targeting generic terms ("project management software") where you're competing against enterprise players with million-dollar SEO budgets

- Ignoring valuable keywords because your tools say "no data" or show volumes so low they seem worthless

The truth? Those low-volume keywords often convert 10-20x better than high-volume alternatives. A query like "CRM for real estate teams with transaction tracking" might get 30 searches per month, but every single searcher is a potential customer actively looking for exactly what you offer.

In this guide, you'll learn how to find these high-intent, low-volume keywords that SaaS competitors overlook, and how to build a content strategy that turns them into qualified leads. We'll cover identifying your users' pain points, leveraging competitor gaps, mapping keywords to the buyer journey, and measuring success beyond raw traffic numbers.

B2B keyword research for SaaS isn't about chasing volume. It's about capturing demand that actually converts.

Why SaaS Keyword Research Requires a Different Approach

Before diving into tactics, let's understand why traditional saas keyword research strategies often fail for B2B software companies.

The Volume Paradox

Most keyword tools pull data from Google's Keyword Planner, which was built for advertisers. It focuses on terms with enough volume to justify ad spend, typically 100+ monthly searches.

But SaaS products often solve very specific problems for niche audiences. Your ideal customer might search for "inventory management for Shopify dropshipping" rather than "inventory software." The first query has clear intent and specificity, the second is vague and competitive.

B2B Search Behavior Is Different

When someone searches for consumer products, they might click on the first result and buy immediately. B2B SaaS purchases work differently:

- Longer research cycles: Decision-makers compare multiple options over weeks or months

- Multiple stakeholders: The searcher might be an individual contributor researching for a team decision

- Technical requirements: Searches often include specific integration needs, compliance requirements, or use case specifications

- Problem-first queries: B2B buyers often search for solutions to problems rather than product categories

This means the keywords that matter most are often the ones that capture someone mid-research, not at the moment of purchase.

The Long Tail Advantage

Long tail keywords (queries with 3+ words that are more specific) make up roughly 70% of all searches. For SaaS, these long-tail queries are where conversion gold hides.

Compare these searches:

- "email marketing" (110,000 monthly searches, massive competition)

- "email marketing for course creators with drip sequences" (maybe 50 searches, but incredibly specific)

The second query tells you exactly what the searcher needs. If your product serves course creators with drip sequence features, that's a perfect-fit prospect.

Start with User Pain Points, Not Keywords

The best SaaS keyword research doesn't start in a keyword tool. It starts with understanding what problems your users are trying to solve.

Mine Your Existing Customer Conversations

Your current customers have already told you how they search. You just need to find it.

Customer support tickets and chat logs:

- What words do customers use when describing their problems?

- What questions do they ask before purchasing?

- What features do they request using their own terminology?

Sales call recordings:

- How do prospects describe their current situation?

- What phrases do they use when explaining their pain points?

- What comparisons do they make to competitors or alternatives?

Onboarding surveys and interviews:

- Why did customers choose your product?

- What problem were they trying to solve?

- How did they find you?

Use Forums and Communities

Your target audience discusses their problems in public, often using language your keyword tools won't surface.

Where to look:

- Reddit: Subreddits for your industry (r/SaaS, r/startups, industry-specific subs)

- Quora: Questions in your product category

- Industry Slack/Discord groups: Real-time discussions about tools and workflows

- LinkedIn posts and comments: Professionals discussing challenges

- G2 and Capterra reviews: Both yours and competitors'

What to capture:

- Exact phrases people use to describe problems

- Questions that get asked repeatedly

- Complaints about existing solutions

- Feature requests phrased as pain points

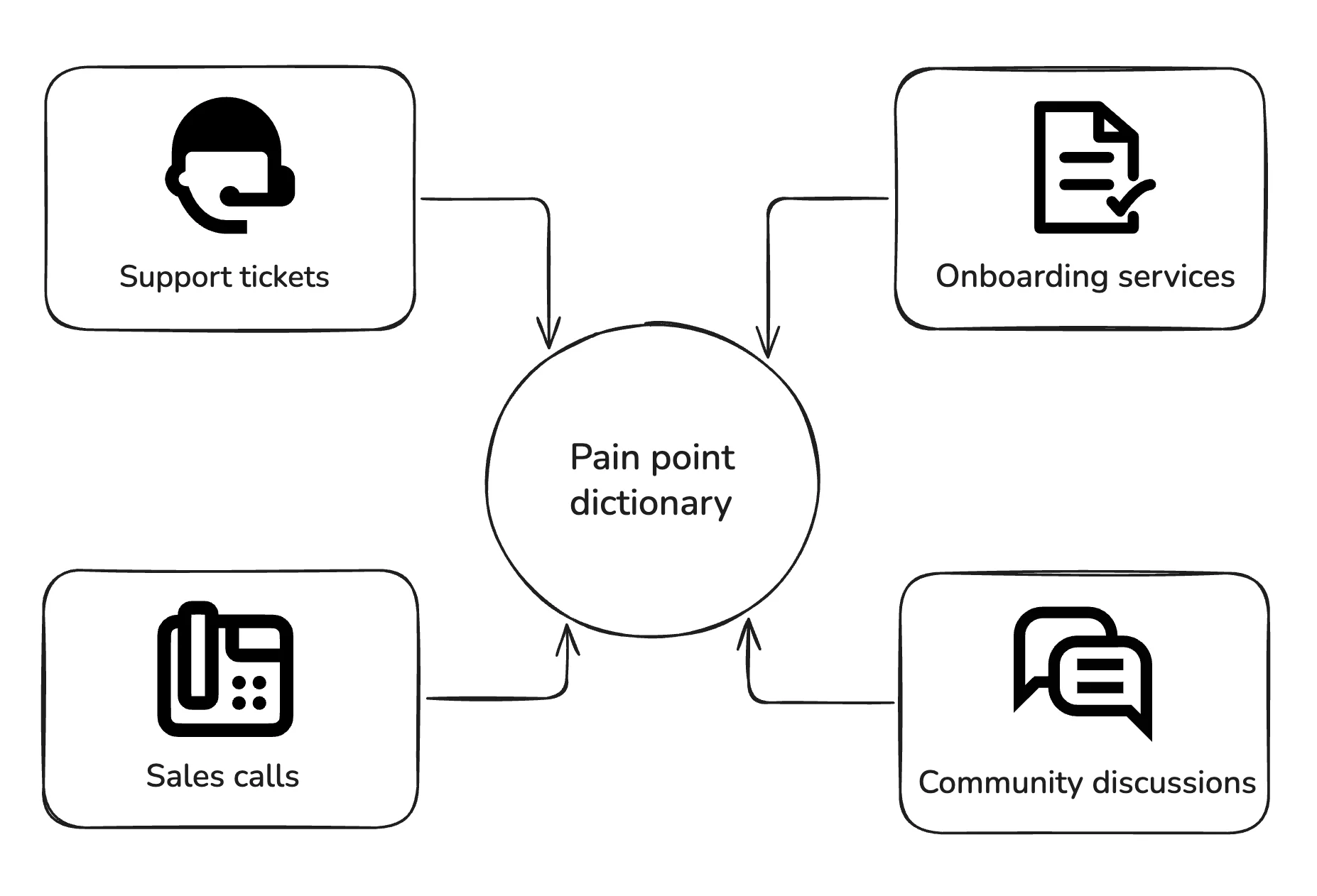

Create a Pain Point Dictionary

Compile what you find into a document organized by problem category. For example:

| Pain Point Category | Customer Language Examples |

|---|---|

| Data silos | "our data is everywhere", "can't see the full picture", "spreadsheet chaos" |

| Team collaboration | "sales and marketing don't talk", "handoff issues", "who owns this lead?" |

| Manual processes | "too much copy-paste", "we're doing this by hand", "takes hours every week" |

| Reporting | "can't prove ROI", "my boss wants numbers", "where's this data coming from?" |

This dictionary becomes your seed list for keyword research, using the actual language your market uses rather than industry jargon.

Finding Low Competition Keywords with High Intent

Now let's turn those pain points into keywords you can actually rank for.

The Low Volume, High CPC Signal

In traditional keyword research, CPC (cost per click) data tells you what advertisers pay for a click. High CPC indicates commercial value, as businesses only pay premium prices for keywords that convert.

For SaaS keyword research, look for keywords with:

- Low search volume (10-500 monthly searches)

- Relatively high CPC ($5+ is a good signal for B2B)

- Low keyword difficulty (easier to rank)

This combination signals a term that's valuable enough for advertisers to pay for, but niche enough that content competition is manageable. If you run paid campaigns alongside SEO, you can use actual conversion data from Google Ads to validate which keywords are worth the content investment. See our guide on unifying SEO and PPC keyword strategy for the complete workflow.

Question Keywords Reveal Intent

Question-based queries (how to, what is, can I, why does) reveal exactly what someone is trying to learn or accomplish.

For SaaS, question keywords often indicate:

- Problem awareness: "why is my email deliverability low" (they have a problem)

- Solution research: "how to automate sales follow-ups" (they're looking for solutions)

- Tool evaluation: "can [competitor] integrate with Salesforce" (they're comparing options)

Focus on questions that indicate someone is actively solving a problem, not just casually curious.

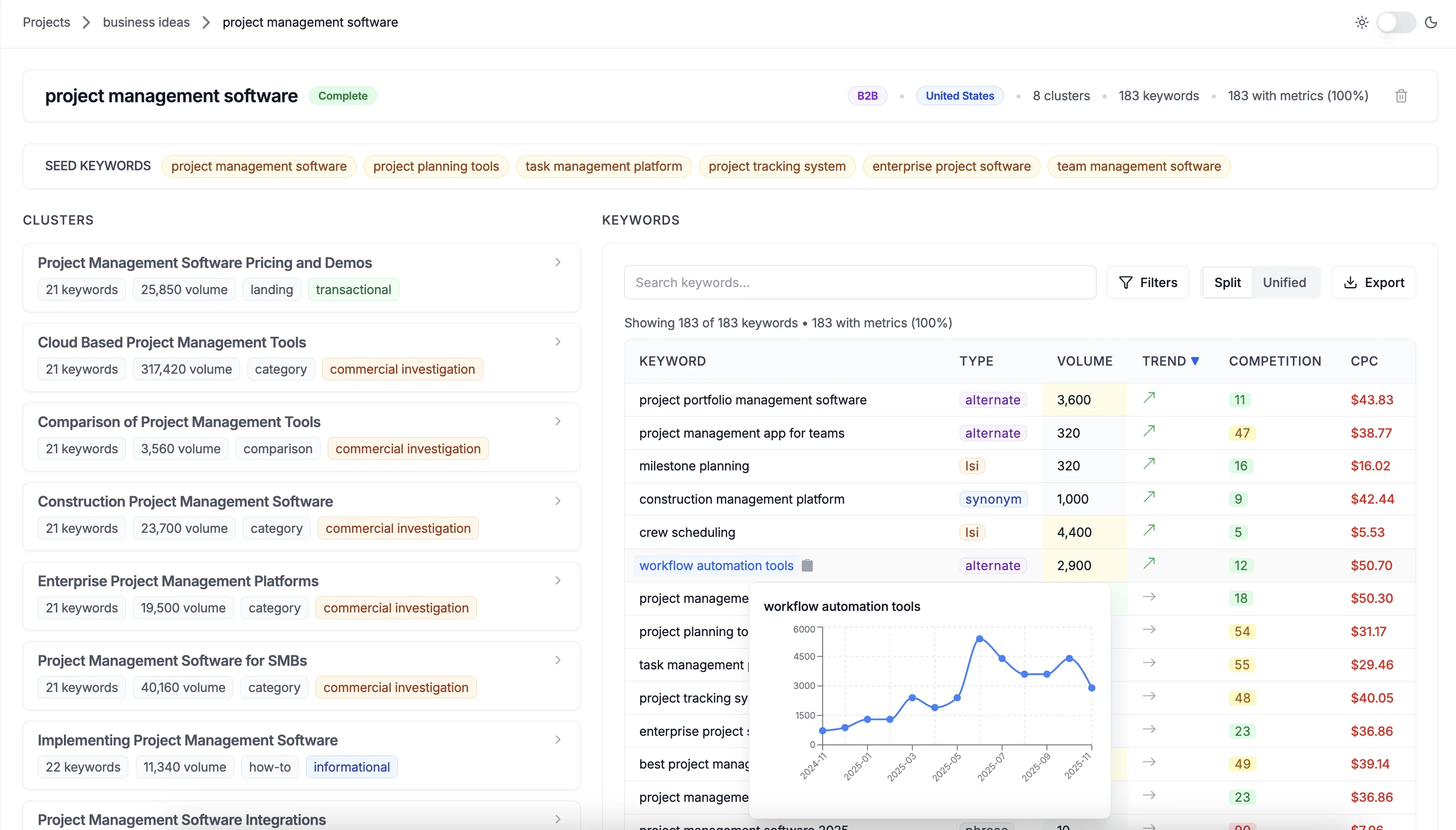

Use BrightKeyword to Find Hidden Terms

Traditional keyword tools often miss niche SaaS terms because they fall below volume thresholds. BrightKeyword approaches this differently.

Instead of starting with seed keywords and finding variations, BrightKeyword uses AI to discover:

- Industry jargon your audience uses but you might not think to search

- Problem-focused phrases that describe pain points

- Long-tail variations that traditional tools mark as "no data"

- Question keywords that capture research-stage intent

Each keyword comes enriched with actual advertiser data, so you can validate that the terms have real commercial value even at low volumes.

Leverage Competitor and Alternative Keywords

Your competitors have already done keyword research. Competitive analysis lets you learn from their work and find gaps they've missed.

Map Your Competitive Landscape

Start by listing:

1. Direct competitors: SaaS products that do what you do

2. Indirect competitors: Alternative solutions (including spreadsheets, manual processes)

3. Adjacent tools: Products your customers use alongside yours

For each competitor, you're looking for keywords they rank for that you don't, especially if those keywords match your product's capabilities.

Find "Alternative to" Keywords

One of the highest-intent keyword patterns for SaaS is "[competitor] alternative" or "alternative to [competitor]."

Someone searching "Salesforce alternative for small business" is:

- Aware of the product category

- Looking to switch or avoid an existing solution

- Ready to evaluate new options

If your product genuinely serves as an alternative, create content targeting these terms. Be specific about what makes you different, and be honest about who your product is and isn't for.

Integration Keywords Signal High Intent

For B2B SaaS, integration keywords often indicate bottom-of-funnel intent:

- "[Your product] [popular tool] integration"

- "how to connect [tool A] with [tool B]"

- "[workflow] automation between [tools]"

If someone is searching for how your product integrates with their existing stack, they're seriously evaluating you.

Keyword Gap Analysis in Practice

A keyword gap analysis compares your ranking keywords against competitors to find opportunities.

The process:

1. Export keywords you currently rank for (from Google Search Console or a rank tracking tool)

2. Export keywords your top 3 competitors rank for

3. Find keywords where competitors rank but you don't (and that match your product)

4. Prioritize by relevance, volume, and achievable difficulty

This reveals content your market expects but you haven't created yet.

Map Keywords to the SaaS Buyer Journey

Not all keywords serve the same purpose. Buyer journey mapping helps you create content for each stage of how SaaS buyers research and purchase.

Top of Funnel: Problem Awareness

At this stage, buyers know they have a problem but may not know solutions exist.

Keyword patterns:

- "why is [problem] happening"

- "how to fix [pain point]"

- "[problem] best practices"

- "common [process] mistakes"

Content types:

- Educational blog posts

- Problem-focused guides

- Industry trend articles

Example: For a project management SaaS, this might be "why projects always go over deadline" or "common project planning mistakes."

Middle of Funnel: Solution Research

Buyers now know solutions exist and are actively comparing options.

Keyword patterns:

- "best [product category] for [use case]"

- "[solution A] vs [solution B]"

- "how to choose [product type]"

- "[product category] comparison"

Content types:

- Comparison pages

- Buying guides

- Feature comparisons

- Use case pages

Example: "best project management software for remote teams" or "Asana vs Monday.com for agencies"

Bottom of Funnel: Purchase Decision

Buyers have narrowed their options and are evaluating specific products.

Keyword patterns:

- "[your product] pricing"

- "[your product] reviews"

- "[your product] vs [competitor]"

- "[your product] features"

- "is [your product] worth it"

Content types:

- Pricing pages

- Customer stories and case studies

- Product-specific landing pages

- Feature documentation

Create Content Clusters Around the Journey

Content clusters group related content around a central topic, with internal links connecting them. This builds topical authority and helps both users and search engines understand your expertise.

For a "project management software" topic:

Pillar content: "The Complete Guide to Project Management Software"

Supporting content:

- "Why Projects Fail: 10 Common Mistakes" (TOFU)

- "How to Choose Project Management Software in 2026" (MOFU)

- "Asana vs [Your Product]: Which Is Right for Your Team?" (MOFU)

- "[Your Product] for Marketing Teams: Features and Use Cases" (BOFU)

Content Strategy for Low-Volume SaaS Keywords

Targeting low-volume keywords changes how you think about content ROI. Here's how to make it work.

Use Case Pages Beat Generic Landing Pages

Instead of one landing page trying to serve everyone, create use case pages for specific audiences:

- "[Your product] for [industry]" (agencies, healthcare, ecommerce)

- "[Your product] for [role]" (marketers, sales teams, operations)

- "[Your product] for [company size]" (startups, enterprises, solopreneurs)

- "[Your product] for [specific workflow]"

Each page targets long-tail keywords while providing highly relevant content for that specific audience.

Answer Questions Comprehensively

When targeting question keywords, don't just provide a quick answer. Build comprehensive resources that cover:

- Direct answer to the question (within the first 100 words)

- Context and background (why this matters)

- Step-by-step solution or explanation

- Common variations and related questions

- Next steps and resources

This approach satisfies the immediate query while building topical authority through depth.

Build Pillar Content Even for Low-Volume Topics

Just because individual keywords have low volume doesn't mean the aggregate is small. A comprehensive guide targeting 50 related low-volume keywords can drive significant traffic.

Example cluster volumes:

| Keyword | Monthly Volume |

|---|---|

| inventory management for shopify | 90 |

| shopify stock management | 40 |

| track inventory across channels | 20 |

| multi-channel inventory sync | 30 |

| prevent overselling shopify | 50 |

| Cluster total | 230+ |

A guide that ranks for all these terms captures more traffic than a single medium-volume keyword, and with higher intent.

Update and Expand, Don't Just Publish

For low-volume niches, treating content as an ongoing asset matters more than publishing volume. Learn how to turn your keyword research into an editorial calendar that balances new content with updates.

Update strategy:

- Check rankings monthly for target keywords

- Expand content that's ranking well but not on page one

- Add new sections when related questions emerge

- Refresh data and examples annually

Measuring Success Beyond Traffic Volume

When you're targeting low-volume keywords, traditional traffic metrics don't tell the full story. Here's how to measure what matters.

Track Lead Quality, Not Just Quantity

A blog post getting 100 visits from perfect-fit prospects beats one getting 10,000 visits from tire-kickers.

Metrics to track:

- Conversion rate by content: Which articles drive signups or demos?

- Lead source quality: Do organic leads from certain content close at higher rates?

- Time to conversion: How long from first organic visit to purchase?

- Assisted conversions: Which content appears in conversion paths even if it's not the final touchpoint?

Set Up Content-Level Tracking

Use UTM parameters and analytics to understand which content drives business outcomes:

- Track organic landing pages in your CRM

- Tag leads by first-touch content

- Report on revenue by content piece

- Identify high-value content topics for expansion

Keyword Position Tracking for Low Volume

Even for keywords with minimal volume, tracking your position matters. A move from position 15 to position 3 might only show a small traffic increase, but it indicates your content is working.

Use Google Search Console to find your actual ranking keywords, including those your tools might miss.

Gather Qualitative Feedback

For low-volume niches, qualitative signals can be as valuable as quantitative data:

- Do prospects mention your content in sales calls?

- Are customers sharing your articles internally?

- Do industry influencers cite your content?

- Are you getting backlinks from relevant sites?

These signals indicate content authority that will compound over time.

Mini Case Study: From 0 to 500 Qualified Visits

Let's walk through a realistic example of low-volume SaaS keyword strategy in action.

The Situation

A B2B SaaS company sells analytics software for subscription businesses. Traditional keyword research showed their main terms ("subscription analytics") had fewer than 200 monthly searches with high difficulty.

The Approach

Instead of targeting the head term, they identified:

Pain point keywords from customer research:

- "why is my churn rate increasing" (40 searches)

- "how to calculate MRR correctly" (90 searches)

- "subscription revenue recognition" (60 searches)

Competitor alternative keywords:

- "[main competitor] alternative" (170 searches)

- "[competitor] vs [competitor]" (40 searches)

Integration keywords:

- "Stripe analytics dashboard" (50 searches)

- "connect Stripe to [BI tool]" (30 searches)

The Results

Over 6 months:

- Created 12 focused content pieces targeting these keywords

- Achieved page 1 rankings for 8 of them

- Generated approximately 500 monthly organic visits

- Conversion rate was 4.2% (versus 0.8% for high-volume blog content)

- Closed 6 customers directly attributable to organic content

The Lesson

The 500 visits from targeted content generated more pipeline than 5,000 visits from generic SEO content had the previous year. Intent trumps volume.

Frequently Asked Questions

How do I find keywords when my SaaS is in a new category?

When you're creating a new category, people aren't searching for your product type yet. Focus on problem keywords ("how to solve X"), adjacent category keywords ("Y software for Z use case"), and educational content that introduces your category while solving immediate problems. Using AI alongside traditional SEO tools can help you discover terminology you might not think to search.

Should I target keywords with zero search volume?

Yes, if they match high-intent pain points. Keyword tools often show "0" for perfectly valid queries that get searched. Use Google Autocomplete to verify: if Google suggests a query, people are searching for it. Also check Google Search Console for queries you're already getting impressions for. Our guide to free keyword research tools covers how to validate keywords using Google's own data.

How many low-volume keywords should I target per article?

One primary keyword with 5-15 related secondary keywords per article. The key is that all keywords should be semantically related and addressable in a single comprehensive piece. Don't force unrelated keywords together just to aggregate volume.

Is it worth ranking for keywords with under 100 monthly searches?

For B2B SaaS with high customer lifetime value, absolutely. If your product costs $500/month and you rank for a keyword that brings 20 visitors per month at 5% conversion, that's 1 new customer per month, or $6,000 in annual recurring revenue from a single keyword.

How do I know if a keyword indicates purchase intent?

Look for modifiers that signal buying research: "best", "top", "vs", "comparison", "alternative", "pricing", "reviews", "for [specific use case]". Also consider the effort implied by the query. Someone searching for a 5-word specific query is putting more effort into their search, usually indicating higher intent.

What's the difference between keyword difficulty scores and actual ranking difficulty?

Keyword difficulty tools estimate difficulty based on the current ranking pages' metrics (backlinks, third-party authority scores like Moz DA). For low-volume keywords, these scores are often unreliable because the sample size is small. Always manually check the SERP: if you see forums, old articles, or weak domains ranking, you can likely compete regardless of the difficulty score.

Turn Niche Keywords Into SaaS Growth

SEO for SaaS isn't a volume game. It's a precision game.

The keywords that transform your organic channel from a cost center to a growth engine aren't the ones with impressive search numbers. They're the specific, intent-rich queries that your ideal customers type when they're actively searching for solutions.

Here's your action plan:

- This week: Interview 5 customers or review 20 support tickets to extract the exact language they use to describe their problems

- Next week: Use those pain points as seeds in BrightKeyword to discover related keywords with commercial intent data

- This month: Create one comprehensive guide targeting a cluster of 10-15 low-volume, high-intent keywords

- Ongoing: Track conversions by content, not just traffic, and double down on what drives qualified pipeline

The SaaS companies winning at SEO aren't the ones with the biggest content teams or highest authority scores. They're the ones who understand their buyers deeply enough to capture demand others overlook.

Your competitors are still chasing volume. Start capturing intent.

(If you're running an ecommerce business rather than SaaS, the same intent-over-volume principle applies. See our guide on ecommerce SEO that converts for B2C-specific strategies.)